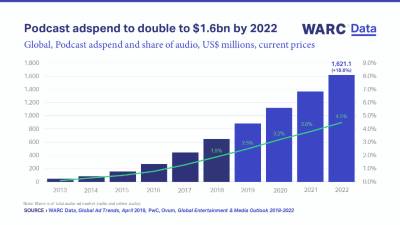

Podcast ad market could reach $1.6bn by 2022, driven by Spotify’s growth plans

WARC, the international marketing intelligence service, has found that podcasts could account for 4.5 per cent of global audio advertising spend in 2022, or $1.6 billion. This is almost double the $885 million in expected investment this year, equal to 2.5 per cent of the audio market (inclusive of broadcast radio and online formats such as in-stream ads).

Much of this money is coming from brands’ experimental budgets. Advancements – such as more accurate, real time audience measurement and programmatic ad trade – are required for this nascent format to unlock future growth.

Spotify’s recent acquisitions of podcast specialists reflect the potential of podcast spend to outpace the wider online audio over the coming years.

The US is by far the world’s largest market for podcast advertising, accounting for an estimated 61.8 per cent of the format’s global spend last year ($402 million). The IAB expects this to grow 28.0 per cent to $514.5 million this year.

James McDonald, Managing Editor, WARC Data, and author of the research, commented, “Podcast advertising holds great potential as it enables brands to reach a highly-engaged, young and affluent audience via a medium they have an affinity with. Spotify is betting big on increasing brand investment over the coming years and has moved aggressively to take ownership of the market.”

He added, “The majority of listeners understand the value exchange between podcasts and sponsorships, so brands need to establish a credible relationship between their messaging and the tone of the content to be effective. Smarter, real-time audience measurement and programmatic buys – a cornerstone of Spotify’s strategy – will also help to propel investment growth.”

Against this backdrop, WARC’s research on podcast advertising highlights three key trends:

Podcast sponsorship offers consumers a clear value exchange

Almost four in five (78 per cent) podcast listeners state that they do not mind ads or sponsorship messages because they know they are a means of supporting the content. This suggests that most consumers understand the value exchange of podcast advertising.

Ancillary research by Edison, published this month, finds that over half (54 per cent) of listeners state that they are more likely to consider a brand following a podcast ad, while Nielsen research shows that a full 62 per cent of listeners correctly recall a podcast ad, and nearly 70 per cent agree that the ad increased their awareness of the new product or service.

Most podcast ads (66.9 per cent) are read by the host, so the establishment of a credible relationship between the tone and the brand is essential to delivering effective messaging.

More accurate audience measurement is required to unlock future growth

Globally, one in three (33.5 per cent) people listens to a podcast each month, with penetration rates varying across key markets: Hong Kong (55.4 per cent), Taiwan (47.1 per cent), Spain (40.1 per cent), US (33.0 per cent), Australia (32.8 per cent), Singapore (32.3 per cent), Norway (31.2 per cent), Italy (29.6 per cent), France (28.0 per cent), Canada (27.9 per cent), Japan (26.3 per cent), Germany (22.2 per cent), and UK (18.1 per cent).

Research from Global WebIndex shows that almost two-thirds (63.1 per cent) of podcast listeners are under the age of 34, while a third (33.0 per cent) are educated to degree-level or higher. Most (62.2 per cent) listen during downtime in the week.

The majority of ad buys (85.1 per cent) are made on a CPM basis, and costs are generally high as demand is outpacing inventory. Downloads are relatively easy to monitor, offering a decent basis for CPM calculations. However, more accurate measurement of engagement and consumer profiling is required on a per show basis for the advertising to realise its potential.

Spotify is doubling down on content in quest to become world’s largest audio platform

Spotify is the third most-popular platform for podcasts, according to Global WebIndex, attracting 28.3 per cent of listeners. This compares to a 53.0 per cent share for YouTube, and a 28.8 per cent share of Apple.

Spotify is investing in the creation of original podcast content through its in-house unit Spotify Studios, in a bid to aggregate and retain listeners. The acquisitions of podcast specialists Gimlet Media, Anchor and Parcast give Spotify expertise as it aims to grow its ad business and margins.

Spotify hopes to monetise podcast ad audiences in two ways: firstly, through brand sponsorship of podcast content, and secondly, via programmatic advertising, which accounts for 12 per cent of Spotify’s US ad revenue (well below the global rate of 65.3 per cent for all online display advertising).

Aside from informing ad targeting, user data can also be leveraged to create personalised and, the company hopes, more engaging playlists (podcast listeners spend twice as much time on Spotify than other users).

Doubling-down on original content also enables Spotify to reduce royalty costs for podcasts. Spotify’s gross margin was 25.7 per cent last year, meaning three-quarters of its income was paid out again, mostly in content acquisition fees.

Global media analysis – Podcasts

- 5% podcasts’ share of all audio ad spend in 2022, up from 1.9% in 2018

- 0% weekly podcast penetration in the US, equating to 62m Americans

- 5% monthly podcast penetration worldwide

- 0% share of listeners who use YouTube for podcasts, compared to 28.8% for Apple and 28.3% for Spotify

- 7% share of podcast ads which are added dynamically, at the point of download

- 78.0% proportion of listeners who do not mind ads as a means of supporting podcast content

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn