MPA analysts track trends in video content consumption across India, Korea & Southeast Asia

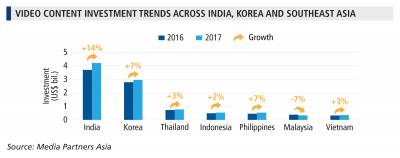

According to the 2018 edition of Asia Video Content Dynamics, published recently by Media Partners Asia (MPA), TV, movie and online video content expenditure across India, Korea and Southeast Asia’s five biggest growth markets (Indonesia, Malaysia, the Philippines, Thailand and Vietnam) rose by 8% in 2017 to reach US$10.2 billion.

The biggest increases came from India, where video content budgets soared by 14% to top US$4.2 billion in 2017, and Korea, where investment in video content increased by 7% over the year to approach US$3.0 billion. The biggest contributors to aggregate incremental growth in video content spend across the seven markets in 2017 were pay-TV (38%) and online video (30%).

India’s 14% annual growth in video content investment was a standout in 2017, driven by pay-TV. Content investment in India’s online video market is also growing rapidly, driven by competition among well-capitalized global and local platforms. This trend should continue over the next three years.

Video content investment in Korea rose by a more moderate 7% in 2017, although growth will likely accelerate when China eventually lifts its ban on Korean dramas, movies and talent. Online video content investment in Korea is also starting to accelerate and will continue to do so over the course of 2018-19.

Growth in production spend across emerging Southeast Asia markets was generally satisfactory in 2017. While free-to-air TV dominates video content investment, the pace of growth slowed substantially in Indonesia, Thailand and Vietnam due to a deceleration and broader volatility in TV advertising.

Malaysia, meanwhile, experienced a decline in video content investment in 2017, mainly due to Astro cutting spend on international pay channels. Declines in free-to-air advertising also reined in Media Prima’s ability to invest in content. The outlook for Malaysia could improve as new government policies bolster economic growth, broadening consumer spend and ad dollars.

Entertainment & Sports

Drama drives audience share region-wide, with a fair degree of cross-pollination across markets. Korean dramas air throughout the region, while Indian dramas have performed well in Indonesia, Thailand and Vietnam. ABS-CBN’s Pasión de Amor rated well in Vietnam. The profile of Thai dramas, particularly after the success of historical drama Love Destiny, is growing.

Sports rates highly across the region. Cricket matches accounted for 24 of India’s 25 top-rated pay-TV programs in 2017. In Indonesia, football matches accounted for 14 of the top 25 programs. Even in markets like Vietnam, where sports accounted for a mere 2% audience share, football matches made up 4 of the top 15 programs in 2017.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn