Mobile All Set to be the Leading Advertising Platform?

Media and Entertainment sector is seeing a convergence of technology, media and telecom (TMT). The reason, obviously, is to facilitate content and marketing on mobile that would captivate the consumer who is spending a large part of his/her time on it.

Media Echo Systems: The Walls Fall Down, a KPMG study released in September 2018 indicates that a key chunk of digital growth is coming from rural and regional markets as the gap between affordability and accessibility is closing. Time spent on digital is also increasing. The report also states that spends on mobile are increasing as it is at the center of the digital ecosystem. In gaming too mobile first is driving the user behavior.

The study shows that advertising revenues for TV showed a growth of 10.3% over fiscal 2017 to INR 223.5 bn in fiscal 2018, while the numbers from print were INR 210.6 bn with a 3.1% growth over the previous year. OOH and Radio grew by 11.9% and 7.9% respectively. It is digital that outpaced other media with a 35% growth and touching INR 116.3 in FY 2018.

The report predicts that by FY 23, digital advertising would grow to INR 435 bn. Not surprisingly, with television advertising predicted at INR 425.3 bn and print advertising predicted at INR 280.7 bn, digital would be the leading advertising media in the country and a large chunk of that advertising money would be for mobile advertising.

Experts believe that there is no need for guesstimates as far as digital spends are concerned – the growth story is for everyone to see and be a part of now. As an outcome, spends on digital have been increasing for the last few years. Anita Nayyar, CEO - Southeast Asia, Havas Media states briefly, “There is a slow and steady shift towards digital and the budgets are coming out of the overall marketing budgets kitty.” She also feels that as the mobile ecosystem improves, ad spends on it would increase. She says, “The potential of mobile especially for advertising has not been optimized given the infrastructure challenges across the country.”

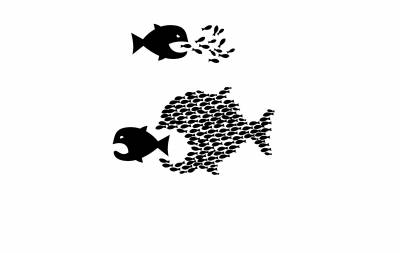

While there is growth in traditional media too, and it would continue to grow in future as well – it might not be able to keep pace with digital media spends. India being a young nation might have a lot to do with it. Mayoori Kango, Managing Director, Performix.Resultrix explains, “We have been seeing the digital Adex growing in double digits for many years now and that money is, of course, coming from traditional forms. We will see more and more of it at regional levels. As more inventory becomes available in regional languages online it might make better sense for some advertisers to move those monies on regional digital players some of it might come from traditional print and some from regional TV channels. She adds, “Majority of India is accessing the web through their phones and of the inventory we buy today, more than 75% is mobile. We need to think mobile first only.”

With consumer engagement increasing on mobile, new content formats coming up, marketers too are trying to discover ways to cater to the new age Indian better. Sahil Shah stresses on the importance of mobile in the overall scheme of things, “Digital = Mobile in my view. More than 85% of Internet consumption in India is on mobile. The new India (Bharat) that’s getting on digital now, is almost 98% mobile and that is the way the whole country is going to be.” He, however, is of the opinion that it would be a scenario where broadcast and mobile (digital) would coexist. He explains, “I feel both TV and digital are here to stay and complement each other in the long run. Monies may shift from one to the other depending on the brand’s requirement. TV does provide unparallel reach (as of now) while digital allows you to custom target users at a decent scale with measurement options.”

Sanjay Tripathy, Co-Founder & CEO, Agilio Labs, too believes that it might be too early to predict a large shift from one medium to the other. He opines, “It all depends on consumer, engagement and time spent. Digital share can go as high as 30% in a couple of years if the current trend continues.” However, when it comes to mobile’s share in digital marketing, he has no hesitation in stating, “It will double from the current level of 35% to 70% in next few years. As the increasingly only pathway to Digital will be through mobile. We are moving from Digital First - Mobile First to Mobile Only due to cheaper data and significantly higher penetration of smartphones.”

Vishal Chinchankar, Chief Digital Officer, Madison World, meanwhile, believes that we can truly call ourselves a mobile first country, and it reflects in the way the medium is growing. He says, “With mobile data becoming more affordable, consumption on mobile is becoming commonplace. Mobiles share in total digital ad spend is 78 per cent. This year mobile continues to grow a healthy pace and the category is expected to maintain a growth rate of 50-55%. We can truly call ourselves as a mobile 1st country.” He also shares numbers indicating a shift in budgets from traditional to digital media, “Overall digital share of media mix is at 18 per cent and this is expected to grow by two to three basis points next year. As per our recent report, Digital has gained three share points at the expense of TV & Print, which lost one & two share points respectively. Having said that digital media has grown at whopping 27.2 per cent in the last fiscal year.”

Indeed, in specific target groups like young adults, professionals continuously on the move and rural populace with little access to computers, mobile is the medium of content and ad consumption. However, would it be a pan India reality in times to come remains to be seen. Wouldn’t broadcast with ever changing technology, always be the preferred medium of entertainment considering the sheer size and clarity of picture? In this backdrop, wouldn’t a set of brands always have a broadcast first strategy? This, and much more at TMMS 2018.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn