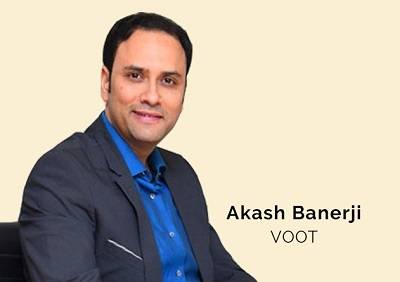

Access, Experience & Rs 12,000-cr growth – Akash Banerji decodes OTT’s march

With the proliferation of digital content and its increasing consumption across mediums, understanding consumer behaviour now plays a critical role. According to an analysis by Talkwalker, Voot, the OTT platform from Viacom18 Media, has been working hard on gaining market share – the buzz for Voot is the highest followed by Netflix and then Hotstar.

Talkwalker further states that Voot seems to have cracked the magic formula to woo female audiences, 62.3 per cent of the viewers of Voot are female – it’s the majority and higher than any other OTT platform for women.

Reinforcing the importance of interactivity on OTT platforms, Voot is strengthening its current offering with the addition of 5 new programmes in the next few months, which will fuel further growth and attract users to the platform.

Voot is also firming up its technology and distribution system by announcing over 20+ new distribution partners across the travel, broadband and mobile ecosystem as well as with OEMs. The OTT platform has partnered with smart TV manufacturer like CloudWalker, ShareIt , Act Fibrenet and travel network company OLA, amongst the others.

Currently driven by an advertising supported video-on-demand model, Voot will continue to build scale by soon diversifying from one business model of AVOD to 4 – Voot AVOD, Voot Kids, Voot International and Voot Freemium.

In conversation with Adgully, Akash Banerji, Head – AVOD Business, Voot, speaks at length about where the OTT industry in India is headed, he also shares some growth projections, growth of vernacular content, garnering more female audiences and much more. Excerpts:

PwC in its recent repot has predicted a 21.8 per cent growth for the OTT industry. Where do you see this growth coming from?

AVOD is currently being projected at around Rs 3,500 crore to Rs 4,000 crore CAGR. SVOD currently stands at about Rs 1,500 crore. The OTT market itself is projected to go more than Rs 11,000 crore - Rs 12,000 crore in the next 2-3 years. The growth and sheer absolute numbers are staggering.

AVOD is projected to be around $1 billion market in 2 years’ time. The balance very clearly is going to come from the subscription business. The pace of growth of subscription is obviously going to be faster, but that is also on a smaller base. So, a larger share of the market is obviously going to be with the AVOD base.

There are a couple of things very clearly driving the market. First is the access, with the sheer growth in the number of broadband users – both mobile and fixed broadband. In the next 2-3 years itself mobile broadband users are going to go up to 800 million; while fixed broadband will reach close to 30 million+ households. We are looking at a billion-internet enabled subscriber market in the next two to three years. This is a great story from an India point of view.

The second big story that is going to lead this huge growth is the coming in of the audiences from the non-metro markets/ regional markets and non-Gen Z consumer segment. Once my presentations used to say that the OTT markets are only about young male metro Hindi-speaking audiences.

In the last one year, what has changed is really radical and tectonic. 52-53 per cent of our consumption is happening on the back of female audiences. The big part of the consumption is on the back of the Tier 2 and 3 markets. It is no more about teeny bopper audiences that are coming on to the platform. The 25+ and female audiences are much more loyal to your platform. Their retention levels are far greater than your male audiences or metro audiences.

How did you crack the formula to on-board female viewers?

There are two very clear enablers for this. Around two years back we saw our female audiences grow in scale and stature. We told ourselves that a lot of the entertainment, drama, and romance content needs to be doubled down. We asked ourselves, instead of focusing on content that will appeal to male audiences – be it original content or acquisitions – how do we give more to the female audiences? In our show ‘It is not that Simple’, the protagonist is a female. Our show, ‘Feet Up with Stars’, has a female anchor. Our content is primarily focused on garnering the female audiences.

While one part is the content story, the other part is the experience. For the audience that is coming on to your platform, the experience has to be that much more intuitive. These were also users who were possibly coming on to the Internet for the first time. When you are using a platform for the first time, you assume that they will struggle a lot in their ability to discover the content. Every facet of our product feature is clearly geared towards getting the user to consume more of that content or similar content pieces.

How do you see vernacular propelling the growth of OTT platforms?

Till about 2 years back, our regional contribution was hovering in the range of 13-15-odd per cent. That number just didn’t seem to grow. Today, our regional contribution is close to 23-25 per cent as part of the entire platform. The sheer absolute growth on the regional side is close to about 4X as opposed to the Hindi content, which is growing by 2.5X. The story in the OTT world is only about the content and the experience.

From an experience point of view, we did something called Geo Local Trays. For instance, suppose someone comes from Karnataka, for them there are specific trays on our platforms based on geo targeting, which will only have that language content. As opposed to showing them Hindi language content on their feed. When I don’t know what my consumer’s consumption pattern is, I still need a starting point. Once I have that point, I can give him what he wants, depending on where he or she is coming from.

Could you tell us about Mavaric and what’s in it for advertisers and content creators?

Mavaric is for the platform. It helps us define the consumer coming to our platform – not just demographic profiling, but across a multitude of factors. His propensity to watch ads, click on ads, affinity to brand categories, engagement to the platform, sampler or frequent user. The moment you have 300-400 different dimensions through which you can segment your consumer, just imagine the power that gets unleashed from the platform to offer that segment to advertisers for sharp targeting and their content team to create and curate content for those specific profiles and even to the marketing team to understand what audience to bring to the platform and where they should be spending money.

My mantra is that consumer lifetime value for different segments needs to be higher than cost of acquiring or cost of servicing. That doesn’t need to be higher than the overall platform level, but rather the individual segment level. The next milestone is to chuck the segments and be able to do this at a unique user level. If digital video is all about data science, analytics and data driven decision making then the world of aggregates has to be thrown out of the window.

What is your strategy for OOH advertising? How much are you spending on it?

Outdoor has two very big objectives. One is that it drives impact. It is simply to grab your attention and is not about reach or GRPs. There is the big reason of trade as well, which is not necessarily limited to consumers. For AVOD platforms, OOH does the work of both. For SVOD platforms, it is mostly about the former. The larger narrative is that with the excess of platforms and too much supply of content, we are all at some level still not playing the game of share of revenue or share of watch time. I think we are still playing the game of share of attention. Digital is still in the phase of evangelising. The more attention the platforms are able to see from their specific audiences, the more the consumers start coming on to your platform and the higher the time spent.

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn