Magna Predicts Adex to grow by +11.5% in 2017

INDIA is recovering from aftereffects of demonetization introduced in Q4 2016 and the currency deficit faced during this period has helped the country leap frog towards a lesser cash economy. The country is set to move towards a uniform tax regime with Goods & Services Tax (GST), effective July 2017, while this fuels growth it is likely to create a fleeting disruption in the short term when the industry realigns and adapts to the new tax structure. GDP in real terms is estimated to grow +7.2% in 2017 compared to +6.8% in 2016 according to International Monetary Fund (IMF). Within the next decade India will gallop to become one of the largest consumer markets in the world according. Rising affluence, ease of doing business, urbanization and enabling infrastructure will contribute to this status.

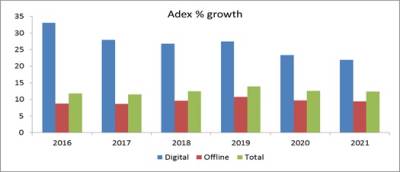

Advertising revenue which is accounts for 0.38% of GDP (gross domestic product) is likely to grow CAGR of +12.6% to touch INR 992bn by 2021. Within Advertising, offline is estimated to grow at a CAGR of +9.7%, while digital will grow at +25.5% CAGR in the next 5 years. Mobile is projected to overtake desktop by 2020. Television will still be the largest media in 2021 with a market share of 39%.

In 2017, Adex is estimated to grow +11.5% to touch INR 611bn, predicts MAGNA, the intelligence, investment and innovation strategies agency of IPG Mediabrands. Ad spends will be driven by sectors like social, fin-tech, and payment banks, telecom service, content distribution platforms etc., in addition to FMCG, Auto and Ecommerce

TELEVISION the foundation of advertising spends continues to dominate the industry with its market share of 41% and will grow+10.3%. With BARC release of rural audience data, new revenue stream in the form of FTA channels have gained significance. Quality localized content and HD experience will help regional TV to keep their audiences hooked. Sporting leagues outside of Cricket is finding way to generate mass involvement and Television will play a larger role. Star Sports Tamil demonstrating tangible results will increase fandom for local/state level formats.

PRINT in India has been successful in guarding its revenues well with revenue expected to grow by +5.7% and India is one of the large markets where circulation is still growing thanks to rising literacy. The second biggest category with 36% share despite growing is losing its share to Digital year-on-year. Traditional sectors like auto, telecom and education will contribute to ad spend growth. After a gap of 3 years, the category will invigorate with the release of new IRS and help publishers realize merit based value. Audit Bureau of Circulation (ABC) measuring digital consumption will lend authority and help in monetization. We expect the ad spends to grow beyond the estimated +5.7% in 2017 thanks to government’s focused campaign to popularize their marquee initiatives.

DIGITAL will grow +28% and within digital, mobile is driving spends with a growth rate of +65.7%. The launch of 4G triggered low price data products there by increase in usage. With improved speed Video, native and customized content has tremendous potential to grow. BARC putting out a road map on digital panel takes India one step closer to a robust measurement not only for digital but also to showcase capabilities in incremental metrics. With expanding content library, OTT viewing is no more restricted to national languages. Aggressive push by Amazon and Netflix to address the original content gap will attract larger base of audience. With mobile increasingly being the choice of access, traffic will be higher than desktop resulting in advertising propelled by mobile which is estimated to grow at CAGR of 48%. E-commerce, Telecom, Auto, BFSI, Durables are large contributors to the revenue.

RADIO reach with around 150 new frequencies sold during phase III is set to deepen further and will help generate incremental revenue. We estimate radio to grow +13% and continue to grow at CAGR of 13.8% in the next 5 years. Currently the measurement is limited to 4 cities, widening this will help radio increase its share from the current 4%

OOH will grow +12% in 2017. Technology integration will increase effectiveness and helps DOOH to drive ad spends. Urbanization in the form of new Metro lines and smart cities, modernization of Indian Railways and their new advertising policy etc., will provide opportunities for a planned development of quality assets and also push the industry to innovate and move beyond billboards. Regional cinema is pushing boundaries to outdo Bollywood cinema which augurs well for the industry.

Table 1 – Media owner revenue by category in INR Cr Net

|

Media Category |

2012 |

2013 |

2014 |

2015 |

2016 |

|

Television |

14092 |

14932 |

16902 |

20080 |

22221 |

|

|

14601 |

15428 |

17032 |

18391 |

19523 |

|

Digital |

2355 |

3157 |

4359 |

5991 |

7990 |

|

OOH |

2028 |

2257 |

2534 |

2842 |

3158 |

|

Radio |

1272 |

1374 |

1539 |

1773 |

1971 |

|

Total |

34347 |

37148 |

42365 |

49077 |

54864 |

|

Media Category |

2017 |

2018 |

2019 |

2020 |

2021 |

|

Television |

24516 |

27416 |

31062 |

34774 |

39012 |

|

|

20644 |

21916 |

23348 |

24696 |

25884 |

|

Digital |

10227 |

12973 |

16538 |

20394 |

24868 |

|

OOH |

3552 |

3979 |

4530 |

5074 |

5642 |

|

Radio |

2227 |

2539 |

2920 |

3329 |

3762 |

|

Total |

61166 |

68822 |

78398 |

88266 |

99167 |

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn