Global ad spend growth at 3.8% amid cautious near-term outlook: DAN

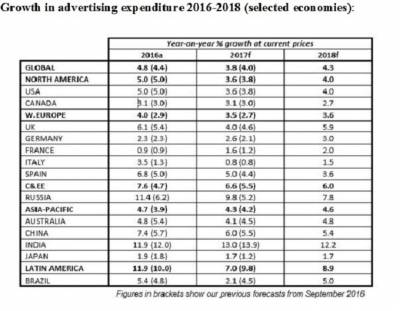

Based on data received from 59 markets across the Americas, Asia-Pacific, Europe, Middle East and Africa, Dentsu Aegis Network’s Ad Spend Forecasts – June 2017 point to a more cautious economic outlook in 2017 than the previous year, with global ad spend growth falling from 4.8 per cent to 3.8 per cent, hitting US$563.4 billion. However, conditions are set to improve in 2018 with forecast growth in ad spend of 4.3 per cent. Events will play a key role in 2018, with events such as the Winter Olympics & Paralympics in South Korea, the FIFA World Cup in Russia and the US Congressional elections all expected to stimulate ad spend growth.

Advertising spend in emerging markets continues to outpace developed economies. For example, ad spend growth in India is forecast to grow at 13 per cent in 2017, while China is the second largest market in the world by share of advertising spend – remaining the only emerging economy to feature in the top five largest ad markets.

Commenting on India’s performance, Kartik Iyer, MD, Carat India, said, “India continues to be amongst the few countries seeing growth rates in double digits. While this may be slightly lower than past expectations owing to various market drivers like demonetisation and GST, the growth is clearly expected to continue. Driving this growth is Digital with a growth rate of over 35 per cent, which is far in excess of that seen by other more traditional media. And with digital quickly progressing on its path of becoming the Go To media for entertainment, this trend is also expected to continue. Other media like TV and cinema are expected to grow at around 12 per cent, while Radio and OOH should see a growth of 10 per cent and Newspapers around 8 per cent.”

“Another medium that is driving growth is that of ambient (at over 15 per cent growth rates). Considering the changing retail environment, the medium, in tandem with digital is becoming pivotal for delivering quality engagement with consumers,” Iyer added.

Despite concerns about the economic impact of Britain’s decision to leave the European Union, UK’s ad spend growth held up better than expected in 2016 at 6.1 per cent. While there are signs of caution in 2017, with growth dipping to 4 per cent, 2018 is forecast to see growth bounce back to 5.9 per cent. A similar picture unfolds in the US, where a slowdown to 3.6 per cent is forecast for 2017, followed by a slight improvement in 2018 to 4.0 per cent. The US also remains the largest market in the world, accounting for 37.7 per cent of the global advertising spend in 2017.

Mobile and digital become the new default settings

Dentsu Aegis Network’s (DAN) forecasts show how digital technology continues to disrupt and drive innovation in the way brands connect with their consumers. In 2017, DAN forecast that advertising spend on mobile will overtake desktop, reaching 56 per cent in terms of share of global Digital advertising spend. In 2018, mobile ad spend will grow further to account for a total of US$116.1 billion. With smartphone subscriptions set to reach 4 billion by 2025 and about a third of consumers reporting that their smartphone is their primary source of entertainment, a trend which is expected to continue.

Furthermore, the forecasts suggest that in 2018 digital will be the top media in terms of global share of spend, taking over television for the first time. Digital’s share of total media spend is predicted to reach a 37.6 per cent share in 2018 (up from 34.8 per cent in 2017), versus 35.9 per cent for television (down from 37.1 per cent in 2017), amounting to a total value of US$215.8 billion. Reflecting the continued disruption by digital technology of the print media industry, Paid Search (advertising within the sponsored listings of a search engine) is forecast to overtake traditional print media (newspapers and magazines) in 2018. Print media has been on a downward trajectory for some years now, but will likely fall to a 13.8 per cent share of total spend in 2018 (down from 15.1 per cent in 2017) while paid search is forecast to grow to 14.6 per cent, up from 13.6 per cent in 2017.

Video, social and programmatic power innovation and growth

While digital ad spend is growing rapidly and set to overtake television, within digital there are a number of new sources of growth that point to the future of advertising. For example, in 2017, online video is set to grow by 32.4 per cent; social by 28.9 per cent; and programmatic (that is, automated ad buying) by 25.4 per cent. Looking ahead, brands will need to embrace the potential of disruptive technologies such as virtual reality, artificial intelligence and voice activation. However, research suggests that only 8 per cent of brands currently intend to use virtual reality for advertising purposes.

Commenting on the latest ad spend forecasts, Jerry Buhlmann, CEO, Dentsu Aegis Network, said, “We are reaching a tipping point in ad spend now as digital overtakes television, mobile overtakes desktop and paid search overtakes print. Digital and data must now be the default settings for advertisers. Evolving to people-based marketing rather than audience-based marketing and using data to increase addressability is essential for brands to manage tighter conditions in 2017 while positioning themselves for future growth.”

He further said, “At the same time, the challenge for brands is to ensure that they are ready to embrace the potential of new innovation. As technologies such as virtual reality and voice activation become more prominent, brands must ensure that they remain relevant by creating new value for their consumers.”

Share

Facebook

YouTube

Tweet

Twitter

LinkedIn